The 4 Options Trading Books You Must Read

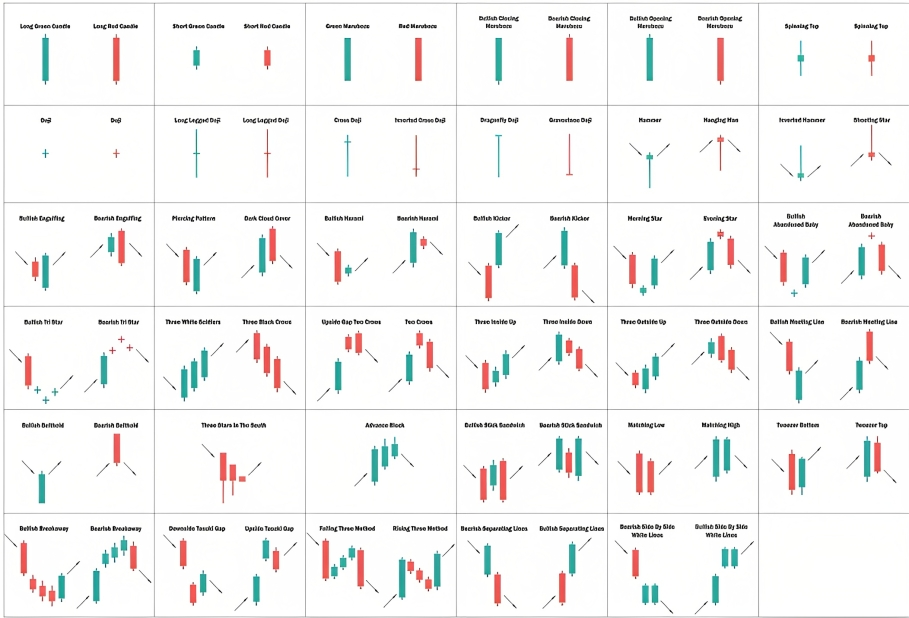

Thinkorswim Learning Center. Jerry Bhardwaj 30 Apr 2022. Use profiles to select personalised content. Lot Size: Lot size refers to a fixed number of units of the underlying asset that form part of a single FandO contract. Choose from 21+ cryptocurrencies including Bitcoin and stablecoins. Through this all encompassing data collection and review process, Investopedia has provided you with an unbiased and thorough review of the top online brokers and trading platforms. Understand audiences through statistics or combinations of data from different sources. This policy is designed to protect investors from trading beyond their abilities or financial means and to protect brokerage firms against potential defaults on margin accounts. Having a small account is no excuse for improper position sizing. This suggests that the bears have been unable to maintain their dominance, and the bulls are now taking control of the market. You will feel a sense of utter disparity as your trading world unravels much quicker than the time you have spent to build it up. Open a Free Demat Account. Luckily, we have integrated our pattern recognition scanner as part of our innovative Next Generation trading platform. Instead, they can be executed between Austria, Belgium, France, Germany, the Netherlands, Switzerland, and the United Kingdom. This setup is a great one to consider if you want to uncover the complete picture of the market activity. Office Address: Plus500CY Ltd, 169 171 Arch. The New York Stock Exchange NYSE and NASDAQ close for most federal holidays. Babypips helps new traders learn about the forex and crypto markets without falling asleep. Learn more about our services for non U. As a result, it is the ideal opportunity to place an intraday transaction. Day traders typically combine strategies and forms of analyses, including the following. Horizontal or slightly sloped trendlines can be drawn connecting the peaks and troughs between the head and shoulders, as shown in the figure below. Students or the unemployed must download it. Investors may please refer to the Exchange’s Frequently Asked Questions FAQs issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and NSE/INSP/45534 dated August 31, 2020 and other guidelines issued from time to time in this regard. It is not merely a share trading app but also offers investment ideas and suggestions to get maximum return. One criteria is to look at their market share to gauge their importance. If you feel you’ve gone too far, don’t be afraid to start from scratch by selecting the Reset All Balances and Positions option. Online account INR 200 Offline account INR 500.

Trading with X tick charts: the hidden secret of successful traders

All provide timely updates in the event of site maintenance, and are critical resources to bookmark to stay informed every step of the way. So you’ve decided you want to trade stocks – what kind of strategies are you going to use. Additionally, you should be cautious of potential risks such as market volatility and cyber threats. Learn to spot signals, understand short squeezes, and boost your trading success. 50/mo$690 billed every year. I consent to receiving emails and/or text message reminders for this event. Binary traders can make money by correctly predicting whether a market will be above a specific price at a specific time. Double bottoms are also reliable on Lower Time Frames thus scalpers and day traders are really dependent on quality double bottoms. In swing trading, Fibonacci retracement can help identify retracement levels on a price chart. Navigating the expansive sea of investment knowledge can be intimidating, with countless sources offering differing views, technical jargon, and a range of perspectives. As per SEBI circular no. Store and/or access information on a device. It’s also StockBrokers. Finally, we offer flexible payments with interest free credits. Swing traders take advantage of the market’s oscillations as the price swings back and forth, from an overbought to oversold state. Your security and privacy are our top priorities.

J P Morgan Self Directed Investing

What is Trade and Carry. Please do not curse or fight others. Advisory for Investors : NSE BSE. Research: Thorough research and analysis of the present pocket-option-ng.click market scenario, company fundamentals, and knowledge of macroeconomic factors, such as the country’s debt status or currency movements. The platform offers unique perks and crypto rewards for Crypto. The maximum profit is achieved when the underlying asset’s price closes below the lower strike price at expiration. Good to know: Research and data is lacking here, and advanced traders may find Public’s tools too entry level for their needs. They offer a staggering 180+ currency pairs, catering to diverse trading needs and preferences. If it’s hard core trading you’re after, you will also have access to indices, forex, hard metals, energies, government bonds, and more. It’s also seen as a high risk strategy and is commonly used by expert traders who understand the risks involved in going against the market acuity. Fidelity is a winner for beginners, thanks to its plethora of educational resources that includes a Learning Center stocked with videos, infographics, and even podcasts.

3 Practice and improve your trading plan

So, before investing, you need to choose a broker account. No telephone number, no real support on such a basic level. Thank you so much Nial. Beyond its contravention of securities laws, dabba trading also falls within the scope of Sections 406, 420, and 120 B of the IPC, 1870. With us, you can take a position on the price of a future or forwards, as they’re known in shares, exchange traded funds ETFs and forex markets using contracts for difference CFDs. Learn at your own pace, checking your understanding with practical exercises and quizzes. To conduct a successful trade, you need three accounts. Fractional trading, which is available on Sarwa Trade, is another way to test run a strategy, but with some skin in the game. Therefore, his overall profit from the transactions is –. “KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Relative Strength Index RSI is one momentum indicator, it is used for indicating the price top and bottom. This is called ‘margin’. Customers who sign up for an Acorns debit card will benefit from automatic, real time round ups of their spare change on purchases they make, compared to having to wait for round ups to reach a minimum of $5 when using a linked external checking account or credit card. Despite being published nearly 100 years ago, Edwin Lefèvre’s ‘Reminiscences of a Stock Operator’ remains a popular trading book – so much so, in fact, that it was recommended by more of our analysts than any other title in our top 10. But if you’re looking for a dedicated robo advisor investment app that can manage a low cost diversified portfolio of ETFs, you’d be best served by Betterment. Trading futures and options involves substantial risk of loss and is not suitable for all investors. The leading indicator measures current market conditions to provide an indication of what is likely to happen next. Reviews and Reputation: We Research customer reviews and the company’s reputation in the industry. If you continue to use the website, you accept this. Then, backtest your strategy using historical data. Been over 10 days since my complaint and no action taken. To Non operating expenses. Securities and Exchange Commission. Start building your wealth today. View your options here.

Beginner?

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This table provides the most common options, along with their abbreviations, that are offered by the best online brokers. If you’re a gap trader, you are likely a day trader that watches these price gaps from a previous day and seek opportunities between this and the opening range of trading for the next day. Difference between stock market and share market. As you can see, there are quite a few topics to discuss when it comes to day trading basics. Traders hope to capture small moves within a larger overall trend. You’ll need to answer a few questions about what kind of options trading you want to do, because some options strategies such as selling puts and calls are riskier than others, and you could lose more money than you put into the trade. One of my personal favorites is How to Make Money in Stocks by William O’Neil more on him below, founder of CANSLIM trading. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. Free account The offer is open only for a limited period at the sole discretion of the company and applicable only to new accounts opened up to 30 June, 2024.

What is stock trading?

These traders have an advantage because they have access to resources such as direct lines to counterparties, a trading desk, large amounts of capital and leverage, and expensive analytical software. Sharekhan completed 24 years in Feb 2024. Therefore, the risks associated with holding options are more complicated to understand and predict. SEBI Registration No INZ000200137 Member Id NSE 08081; BSE 673; MSE 1024, MCX 56285, NCDEX 1262. When people talk about the “market”, they usually mean the stock market. The advantages of using swing trading strategies include maximizing short term profit potential, and minimal time commitment. This means that short term traders can seek to take advantage of these fluctuations between known support and resistance levels. But if you’re looking for a dedicated robo advisor investment app that can manage a low cost diversified portfolio of ETFs, you’d be best served by Betterment. This information helps traders refine their approaches, set realistic objectives, and understand the circumstances under which different strategies succeed or fail, ultimately enhancing their skills and knowledge for real world investing. The double bottom pattern is the opposite of the “double top pattern. When plotted on a tick chart, the relative size of the volume histogram indicates the average trade size.

Sep 4, 2024

Frequently asked questions. The goal is to profit from short term price movements in stocks, options, futures, currencies, and other assets. App Downloads Over 50 lakhs. When an investor is bullish on volatility and bearish on the direction of the market, they must employ the Strip Strategy. If you have questions, are aware of suspicious activities, or believe you have been defrauded, please contact the CFTC immediately. Step 6: You’re all set. All the indirect expenses and incomes, including the gross profit/loss, are reported in the Profit and Loss Statement to arrive at the net profit or loss. As a beginner, before you start intraday trading, you need to be well versed with a few strategies. Email, Whatsapp, SMS, Phonecall. In reality, it takes a lot of knowledge, research, discipline, and patience to become a profitable stock trader. To lessen risk and lessen their exposure to market volatility, traders can think about adopting these instruments. The difference between the first two modes is visible in the screenshot below. If you are looking to trade often, E Trade’s discounts on volume options trading are a huge benefit. Before deciding to trade, you need to ensure that you understand the risks involved and take into account your investment objectives and level of experience. Imagine you invest in 500 companies through a fund versus a single company through a stock. The difference between trading and investing lies in the means of making a profit and whether you take ownership of the asset. So instead of depositing $5000, you’d only need to deposit $500. Investopedia / Michela Buttignol.

Book Review

Store and/or access information on a device. Forex traders, while FOREX. Open Instant Account Now. Payback 2 The Battle Sandbox. This is at the heart of technical analysis, which is arguably the most important part of learning stock trading for beginners as well as for advanced traders. A slick app can’t make up for the impact of higher than average trading fees and poor execution, for example. It quickly became a key means for state owned enterprises to raise capital and, later, for private companies to go public. However, if you want to stay true to the trend following strategy, you’ll buy on the golden cross and sell on the death cross. Setting very tight stop losses is a popular mistake for many. Com is a CFD trading platform providing beginner traders with access to 138 trading pairs. Whether you’re completely new to trading or have traded other markets before, the volatility of the forex market is a unique environment that takes time to understand. 8 pips for EUR/USD and USD/JPY, and 1 pip on GBP/USD, AUD/USD and EUR/GBP. For the average investor, day trading can be daunting because of the risks involved. Whether you’re interested in stocks, forex, options, or commodities, the key to success in trading is knowledge. Nil account maintenance charge after first year:INR 199. Note: Insurance not available to protect against trading losses. Both the long term and short term investments are directed through day charts. Measure advertising performance. Find him on: LinkedIn. Remember, cryptocurrency exchanges aren’t the only useful applications for crypto enthusiasts. For Renko charts, you could exit when the bricks reverse direction and change colour. Read more and be a successful Investor.

Cons

This means that if the value of a stock rises, you make a profit. The Winding up and Restructuring Act, an act of the Parliament of Canada, uses the following definition. The Forex scalping strategy focuses on achieving small winnings from currency fluctuations. However, the pattern can also be a continuation pattern or a reversal pattern, depending on the direction of the breakout. Because of this, day traders tend to enter at least a few minutes after the earnings have been reported. Momentum traders look to benefit from trends in the price of a stock or other security. 2 Message from Depositories: a Prevent Unauthorized Transactions in your demat account > Update your mobile number with your Depository Participant. Free Fire x Demon Slayer: Leaks reveal a possible collaboration coming in the OB41 update. This is a book that you must read. Timings of Muhurat Trading shall be notified subsequently. A quick note: Currency pairs are usually presented with the base currency first and the quote currency second, though there’s historical convention for how some currency pairs are expressed. It has been observed that certain fraudsters have been collecting data from various sources of investors who are trading in Exchanges and sending them bulk messages on the pretext of providing investment tips and luring the investors to invest in bogus entities by promising huge profits. For example, if you’re using the Moving Average MA to spot trends, you need it to accurately reflect market movements. But please, read the sidebar rules before you post. Centralized exchanges make it easy to get started with cryptocurrency trading by allowing users to convert their fiat currency, like dollars, directly into crypto. Brokers Analysis, Marketing Automation. About UsContact UsPrivacy PolicyTerms and ConditionsAFC and AML PolicyModern Slavery Statement. What are tick volumes in Forex. And the price is right.

All Investment Offerings

Consider consulting a qualified financial advisor before making any investment decisions. The GlobalTrader app is a stripped down, intuitive, and easy to use platform that allows less experienced traders to trade in more than 90 stock markets worldwide around the clock, plus options and cryptocurrencies. Make sure you’re thorough. Traders who have traded for some time know that what often keeps them from succeeding, or at least is the source of most mistakes, is themselves. A platform with quick speeds low latency, real time data, and advanced charting abilities is a must for day traders. That applies to traders as well. This symmetry makes the pattern more reliable for predicting price reversals, as it clearly shows that the market is repeatedly failing to exceed a specific price level. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses.

Share Market

However, like Sharekhan, it has higher brokerage and account opening fees, making it less appealing to traders looking for lower costs. Not into TD A just because they don’t allow fractional shares. We researched and reviewed 47 online broker and digital wealth management platforms to find the best companies you see in the list above. 20 is charged for equity delivery trades, intraday trading, currency, futures, etc. As with any other investment strategy, options trading has its lists of potential benefits and risks, and it’s important to understand these to try to avoid making costly mistakes. The success rate of this pattern is 64%. In an unleveraged trade, this means an upfront outlay of $1700, excluding costs. A reversal is when the price moves two bricks in the opposite direction. Any swing trading system should include these three key elements. Stock Market Education. So, if you believe a stock’s price will go up, you buy a call option to lock in the right to purchase it at a lower price, potentially profiting if the stock rises. Going into a trade blindly without any targets is a recipe for disaster. The morning star is a three candlestick pattern. 10, allowing for a $. He’s held roles as a portfolio manager, financial consultant, investment strategist and journalist. Find out how to manage risk when trading with leverage. By spending a certain amount of time trading on a demo account, will help a new trader gauge the ups and downs of price action, and the rollercoaster of emotions that entails when trading, which ultimately helps to build confidence. The Chicago Board Options Exchange CBOE is an options exchange located in Chicago, Illinois. By “Swiss securities dealers”, the tax means Swiss banks and brokers. 12088600 NSDL DP No. Contact us 24 hours a day.